As the year draws to a close, it’s time for businesses to reflect on their financial health and prepare for the upcoming year. Managing finances can be a daunting task, especially with various reports, tax obligations, and year-end closing procedures to consider. QuickBooks, a leading accounting software, offers a range of features that can simplify this process, making it an invaluable tool for business owners. Here’s how QuickBooks can help you prepare your finances for the end of the year.

1. Streamlined Financial Reporting

QuickBooks provides a comprehensive suite of financial reports that can help you gain insights into your business’s performance over the year. With just a few clicks, you can generate profit and loss statements, balance sheets, and cash flow statements. These reports enable you to identify trends, assess profitability, and make informed decisions moving forward. By analyzing these reports, you can spot areas that need improvement and strategize effectively for the upcoming year.

2. Simplified Tax Preparation

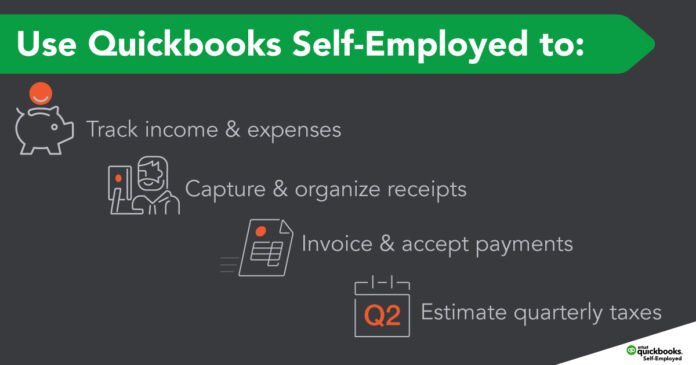

As tax season approaches, preparing your financial data becomes crucial. QuickBooks automates many tax-related tasks, ensuring your records are accurate and up-to-date. The software categorizes income and expenses, making it easier to track deductible expenses and prepare your tax returns. Additionally, QuickBooks integrates with various tax software, allowing for seamless data transfer, saving you time and reducing the risk of errors.

3. Expense Tracking and Categorization

Keeping track of your expenses throughout the year is essential for financial clarity. QuickBooks allows you to categorize expenses automatically, helping you monitor spending in real time. This feature is particularly useful at year-end when you need to assess your expenditures for tax purposes. By categorizing expenses accurately, you can maximize your deductions, ultimately reducing your tax burden.

4. Inventory Management

For businesses that sell products, inventory management can be a complex task, especially as the year ends. QuickBooks offers tools to manage inventory efficiently, providing real-time tracking of stock levels, sales, and orders. By keeping your inventory organized, you can avoid overstocking or stockouts, which can negatively impact your business’s financial health. Additionally, accurate inventory records can help you make better purchasing decisions for the upcoming year.

5. Budgeting and Forecasting

Planning for the future is a critical aspect of year-end financial preparation. QuickBooks enables you to create budgets and forecasts based on historical data, helping you set realistic financial goals for the next year. By analyzing past performance, you can identify growth opportunities and allocate resources effectively. The budgeting feature also allows you to track your actual performance against your budget, providing insights into areas where you may need to adjust your strategies.

6. Year-End Closing Procedures

QuickBooks simplifies the year-end closing process by guiding you through essential steps, such as reconciling accounts and closing books. The software provides checklists and reminders, ensuring you don’t overlook critical tasks. By following these procedures, you can confidently close out the year and start fresh with accurate financial data.

Conclusion

As the year comes to a close, it’s essential to ensure your financial records are accurate, organized, and ready for tax season. QuickBooks offers a robust set of tools that can streamline this process, making financial management more manageable for business owners. By leveraging its features for reporting, tax preparation, expense tracking, inventory management, budgeting, and year-end procedures, you can position your business for success in the new year. With QuickBooks by your side, you’ll be well-equipped to navigate the complexities of year-end financial preparation.